Remember: Recoveries have rewarded patience

If you've ever taken an economics course, you might remember this basic principle: Economies and financial markets, such as the stock and bond markets, move in cycles. That is, you can count on markets to experience lows, when prices fall, and peaks, when prices reach their highest. While no one has perfected the science of knowing exactly when those lows and highs will occur, you know the financial markets (and most global economies) will eventually back around.

This underscores the importance of maintaining a diversified, properly balanced portfolio (versus a highly concentrated, non diversified one), which can more effectively withstand the shock of a market downturn. Perhaps more important, the inevitability of market cycles illustrates why reactive selling amid a downturn is harmful in the long run.

Taking the long view

When the financial markets are in turmoil and account balances start to fall, there can be a strong temptation to ask your financial advisor to "do something" to stem any perceived losses. Yet it is often the case that staying t he course-or doing nothing-proves to be the better path.

he course-or doing nothing-proves to be the better path.

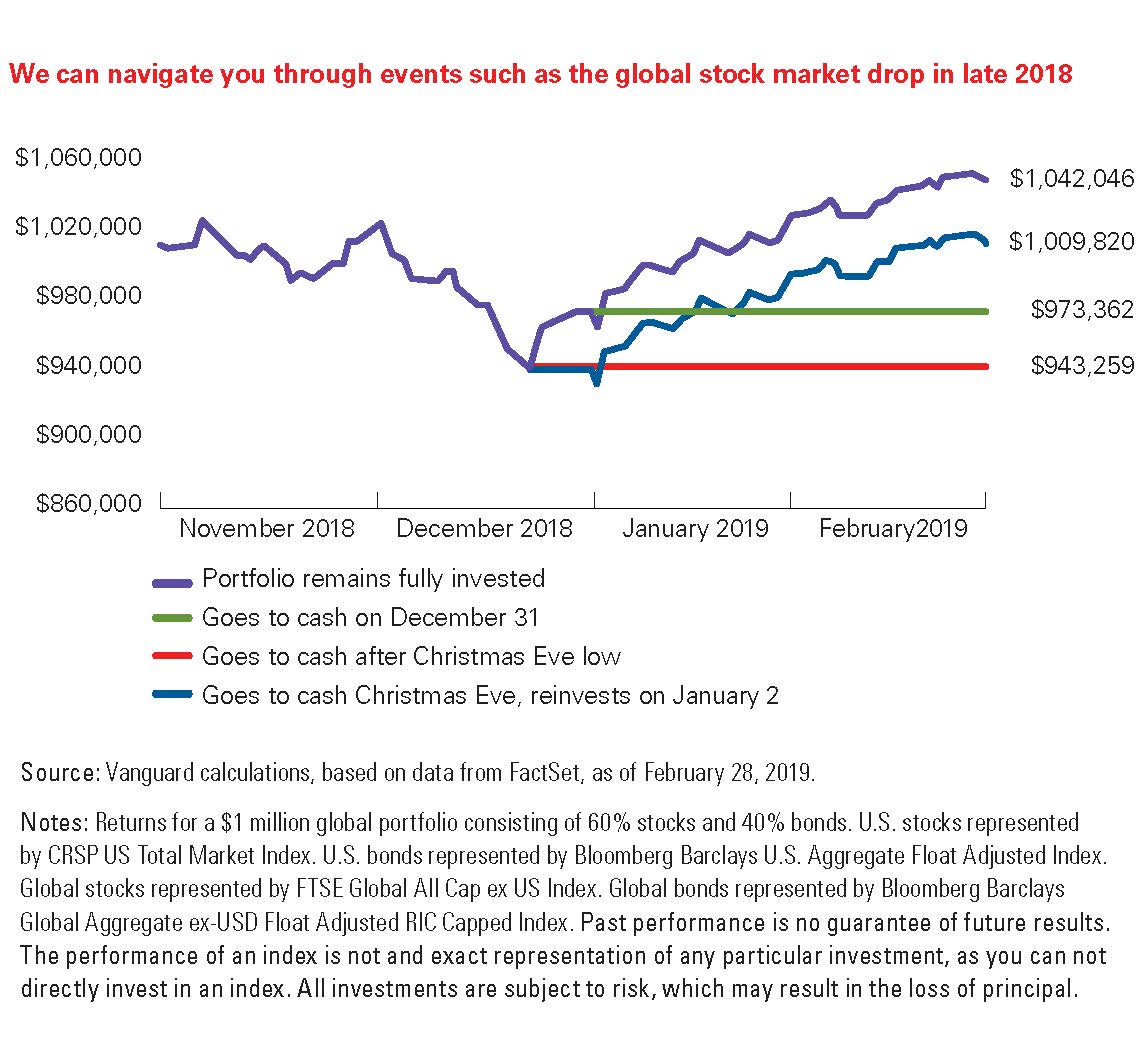

Here is a recent example: A hypothetical 60% stock/40% bond portfolio that stood at $1 million on the morning of November 1, 2018 would have lost 5.7% of its value by Christmas Eve. Yet selling the portfolio at that time and fleeing the markets, even if briefly, would have cost an investor tens of thousands of dollars in two months, versus the alternative of staying invested.

When faced with a similar situation, consider how you might feel if markets rebounded and you could have recouped all your money, and more. That's why it's best to stick to the long-term plan you and your advisor have built. Any changes should be made because of changes in your life, not changes in the market. If you have questions about making portfolio moves, remember to talk to your financial advisor before acting.

Make successful investing easy - make a plan

Just as you buy health insurance plan to cover you and your family against sickness and injury, it's smart to create a contingency plan for your portfolio for when the markets slide.

With a plan in place, it's easier to tune out the noise that seems to amplify itself during times of financial stress (for instance, the one-size-fits-all advice of stock-picking gurus on financial news programs). Think of a plan as being like a suit of armor against impulsive decisions that could threaten your goals. A plan can be as simple as riding out any market downturns, without making any changes. Or perhaps it involves adjusting your asset allocation at regular intervals, so you experience less volatility and less disruptions to your income if you're retired and drawing down your investment.

You and your advisor can figure out together what type of proactive plan may work the best in your circumstances. Market downturns-or even just the thought of them-can cause lots of concern. And they certainly can make an ugly dent in the portfolio you worked so hard to build. The good news is with patience and a little planning, you can breathe easier knowing that better market conditions will eventually reappear.

All investing is subject to risk, including the possible loss of the money you invest.

Diversification does not ensure a profit or protect against a loss. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Investments in bonds are subject to interest rate risk, credit risk, and inflation risk.